10 outstanding walks to enjoy during May to celebrate National Walking Month

by helen hall on April 1, 2022May is National Walking Month and, as the weather starts to improve, it’s the perfect time to plan a hike in some of the UK’s most beautiful locations.

National Walking Month aims to encourage people to walk more every day. It can help improve your mental and physical wellbeing, as well as reducing your carbon footprint. While walking to work and visiting your local park are excellent ways to take part in the awareness month, why not plan a trip to one of the nation’s favourite walks?

The Ordnance Survey asked more than 8,000 walking enthusiasts to identify the best walking route in Britain. Here are the top 10 responses.

1. Helvellyn, Lake District National Park

The Helvellyn walk in the Lake District was named the best route in Britain and it’s just one of several walks in the top 10 located in the national park.

The walk is 16.3 kilometres and takes around six hours to complete. You will need a good level of fitness and be comfortable with heights to complete this challenging mountain walk. But the rugged beauty will definitely make it worth your while.

2. Snowdon, Snowdonia National Park

Snowdown is the highest mountain in Wales, and it’s well worth a visit even if you don’t want to scale the summit.

If you do decide to tackle the walk, there are six routes to choose from with varying levels of difficulty. The Llanberis Path is the easiest and longest route to reach the summit. It is around 14.5 kilometres and takes six hours to complete.

If you’re an experienced hiker and want a challenge, the Watkin Path is the most difficult and guarantees stunning scenery.

3. Malham and Gordale Scar, Yorkshire Dales National Park

This circular route takes you through stunning natural areas in the Yorkshire Dales. It covers just over 12 kilometres and can be completed in under four hours.

During that time you’ll be taken through dramatic landscapes, from Malham Cover to Janet’s Foss Waterfall, and Malham Tarn, the highest lake in Britain. You can also see evidence of early settlements and an abundance of wildlife. If you’re looking for an easier walk, try going from Malham village to Janet’s Foss instead.

4. Catbells, Lake District National Park

The Catbells walking route in the Lake District is popular with families thanks to its shorter length. At five kilometres and taking a little over two hours to complete for the average walker, it’s suitable for most abilities, although there are some steep climbs.

You can enjoy views across the Newlands Valley and Western Fells as you stroll around the route so there are plenty of photo opportunities.

5. Scafell Pike, Lake District National Park

As the highest mountain and war memorial in England, Scafell Pike attracts thousands of visitors each year. There are three routes you can take to reach the summit, and all are strenuous. So, if you’re a beginner hiker, you may want to choose a different walk in the Lake District.

If you decide to tackle the mountain, you can expect it to take around five hours to complete the 11.6 kilometre route. You’ll find some of the best views of the Lake District on this walk.

6. Tryfan, Snowdonia National Park

Located in Snowdonia, the Tryfan walk offers some of the most dramatic mountainous scenery. There are several routes up Tryfan but all are hard. So, it’s not a route that’s suitable for casual walkers.

Those that do have the experience to climb Tryfan can expect it to take around five hours and they will be rewarded with spectacular views.

7. Buttermere, Lake District National Park

If you’ll be visiting the Lake District, Buttermere is another great walk to add to your list. It’ll take you around Buttermere Lake and offers incredible views of fells and mountains. It’s been a popular walk since the Victorian age.

It’s an excellent option if you want a walk that’s suitable for all abilities without compromising on the scenery. A walk around the entire lake is less than seven kilometres and can be completed within two hours.

8. Old Man of Coniston, Lake District National Park

Yet again, the Old Man Coniston walk is in the Lake District, proving just how popular the national park is with walking enthusiasts. The Old Man Coniston walk is a circular route that loops around Brown Pike.

It’s a longer walk, taking around five hours to cover 12 kilometres, and so still suitable for most people. You can choose a shorter route, which is steeper, or opt for the long, gradual path. As well as the views you’d expect in the Lake District, you can also see industrial archaeology, including old quarry machinery and building foundations along the walk.

9. Dunstanburgh Castle, Northumberland

This walk is perfect for all walking abilities. Starting in the fishing village of Craster, you’ll follow the Low Newton coastal walk. You can enjoy stunning views across a sandy bay before you arrive at the mighty ruins of Dunstanburgh Castle. The castle dates back to 1313 and you can purchase tickets from English Heritage if you’d like to go inside.

The circular route will take around an hour and 15 minutes, not including any stops you want to make, and covers a little more than four kilometres.

10. Mam Tor, Peak District National Park

At the top of Mam Tor, you can find some of the most dramatic views of the Peak District over Hope Valley and Edale. You can also see remains of iron age forts and walk along the Mam Tor landslide road.

There are 10 routes you can take to Mam Tor, with varying degrees of difficulty and length, but all are circular. The short three-mile walk is perfect for families, while the 20-mile hike is ideal if you want a challenge.

read more33% of couples say they’re financially incompatible. Here are 7 tips for creating financial harmony

by helen hall on April 1, 2022How often do you talk about money with your partner? The way money is handled in a relationship can sometimes make or break a couple, and research suggests it’s something many people struggle with.

According to a survey from Royal London, 62% of couples in the UK say they have argued with their partner about money. The most common reason is that one partner is deemed to be “spending too much”.

While disagreements are part of every relationship, a worrying third of couples say they’re incompatible with their partner when it comes to spending and saving. And a quarter considers their partner to be irresponsible with money.

How you handle finances now affects your long-term plans, so finding a way to create financial harmony as a couple is important. It can not only reduce arguments but mean you’re both working towards the same goals.

If money decisions can cause some friction in your relationship, here are seven tips that could help.

1. Make money topics a part of your normal conversation

Despite money playing a huge role in your life, the research found that couples often find it difficult to talk about finances.

Making money topics part of the conversation in your home is an important first step. Sometimes, disagreements may occur due to a misunderstanding that being more open can solve. In other cases, a conversation can help you understand your partner’s view so you can minimise financial challenges.

2. Be open about your financial situation

If you currently keep your finances largely separate from your partner, they may not be aware of your situation, and vice-versa.

Being open about debt, outgoings, and other areas of finance can mean you’re both in a better position to understand the financial decisions being made. It can also give you an insight into how your partner views money and where your differences may lie.

Understanding your partner’s financial situation is particularly important if you’ll be making a financial commitment with them, such as opening a joint account or taking out a mortgage.

3. Create a joint household budget

If you share household expenses, understanding how they will be split and what they will cover is important.

For some couples, simply splitting expenses 50-50 makes sense. For others, taking income differences into account may be better suited.

What’s important is that you find an option that works for you and create a plan that matches your needs. This may mean depositing a set amount into a joint account every month or each of you taking responsibility for different outgoings.

4. Give yourself and your partner a discretionary budget

How your partner spends money can be a cause of conflict, especially if you don’t agree with their purchases. If this is something you argue about within your relationship, giving yourself and your partner a set budget to use however you like can avoid this.

It means you can both indulge in what’s important to you while knowing that you’ll still be on track to cover essentials and other financial goals you may have.

5. Set out clear saving and investing goals

With a day-to-day budget organised, it’s time to start thinking about other goals you may want to set aside money for. This could be to buy a house, start a family, go on holiday, or build a financial safety net.

Having clear saving or investing goals means you’re both working towards the same things.

Knowing that you both need to put money away at the beginning of the month means you know where you stand, and it can minimise arguments.

6. Don’t overlook long-term goals

Saving goals looking ahead for the next few years are important, as are ones that will affect your life in several decades.

The sooner you start thinking about areas like retirement planning, even if it seems a long time away, the more manageable your goals will be.

If you haven’t discussed how much you and your partner are putting away in your pension each month, for example, it can be difficult to calculate if you’re on track for a financially secure future as a couple.

So, when setting out a budget and what you want your future to look like, don’t put off long-term planning.

7. Work with a financial planner

Balancing different goals and views on money can be a challenge. By working with a financial planner, you can create a plan that you can both have confidence in and incorporates both of your aspirations to provide long-term security.

The financial planning process can help make sure you’re both on the same page, from discussing what your long-term goals are to reviewing your risk profile when investing. These steps can mean your financial decisions reflect what you both want from life with a clear blueprint to follow.

If you’d like to arrange a meeting with us, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

read more8 things entrepreneurs can do to improve their financial resilience

by helen hall on April 1, 2022More people than ever before are working for themselves and setting up businesses. It can be incredibly rewarding, but you also need to consider how it’ll affect your financial resilience.

The UK has a great spirit of entrepreneurship. According to the Office for National Statistics, around 4.8 million people (more than 15% of the labour force) is self-employed, and it’s something younger generations are continuing.

According to a report in Business Leader, 50% of new businesses set up between July 2020 and June 2021 were done so by people aged between 25 and 40.

And Generation Z, who are under 25, is already responsible for 7.8% of new companies.

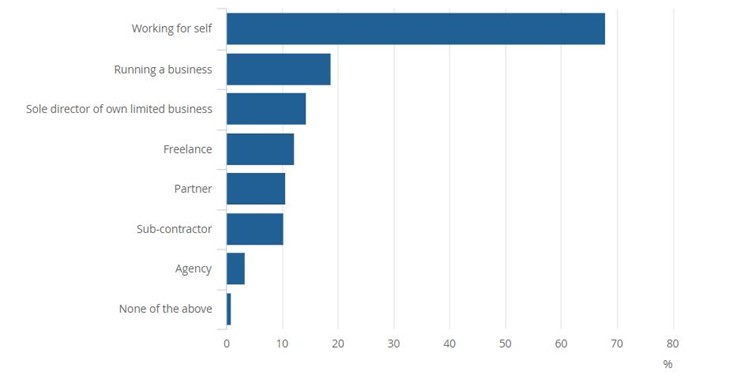

The data suggests that being self-employed is going to become even more common in the coming years. The graph below shows the different types of self-employment across the UK.

Source: Office for National Statistics

If you’re among those who are self-employed, taking these eight steps can help improve your financial resilience and long-term wellbeing.

1. Set personal goals

When you’re building up connections or starting a business, it can be easy for that to become your sole focus. However, personal goals are just as important and can help you live a more fulfilling life.

Personal finance goals, like being able to pay off your mortgage or retire early, can provide motivation and ensure you have a clear direction for life outside of work.

2. Review your budget

As you’ll be responsible for your income, understanding your budget is crucial. The questions below can help you track your cash flow and make informed decisions about your spending:

- How much are you making?

- Does your income vary?

- What are your essential expenses?

- How much are you saving regularly?

3. Consider income protection

While on the subject of managing your income, how would you cope financially if you became too ill to work? While no one wants to think about being involved in an accident or having a long-term illness, it does happen.

Income protection policies can provide a regular income if you’re not able to work. You will need to pay regular premiums, but it means you can focus on recovering should something happen to you.

How much your premiums are will depend on your health, lifestyle, and level of cover required, and it can be cheaper than you expect.

Despite this, a Nationwide Building Society poll found that 3 in 10 people had nothing in place to support them financially if they couldn’t work. Many others would rely on savings, borrowing from family or friends, or using a credit card or loan.

4. Review whether critical illness cover is right for you

As well as income protection, you may also want to consider critical illness cover.

This type of policy would pay out a lump sum on the diagnosis of illnesses named within the policy. It can provide financial security if you’re diagnosed with an illness like cancer, stroke, or multiple sclerosis. You can use the lump sum however you like, from paying off your mortgage to covering day-to-day costs.

Again, you will need to pay premiums and the cost will depend on your health, lifestyle, and level of cover.

5. Don’t neglect your emergency fund

Whatever your employment status, an emergency fund is important. It provides a financial buffer in case you face unexpected costs, such as repairing your roof after a leak.

If you’re working for yourself, it can also be a useful fund if you experience a slow period or need to take time off.

How much you should hold in an emergency fund will depend on your commitments and other assets. A rule of thumb is to have three to six months of expenses in a readily accessible account.

An emergency fund is vital for building financial resilience. Yet, a report in International Adviser suggests that 51% of UK adults do not have enough emergency savings. The poll found that it wasn’t just an issue for low earners either: 23% of households earning more than £100,000 said they couldn’t cover their essential outgoings for three months.

6. Set up a pension and make regular contributions

While most employees now have a pension opened on their behalf by their employer, entrepreneurs will need to take their own steps to secure their retirement.

Opening a pension and making regular contributions is a great first step to building long-term financial resilience. As well as your own contributions, your pension can also benefit from tax relief and will be invested to hopefully deliver growth over the long term.

Understanding if you’re saving enough for retirement can be difficult. We can help you create a retirement plan that suits your goals, and balances your spending now with the future.

7. Make the most of tax allowances

Managing your tax bill can help your money go further. As an entrepreneur, there may be additional tax allowances you can make use of now or in the future.

Business Asset Disposal Relief (BADR), for example, can be used when you want to sell all or part of your business, to reduce the amount of Capital Gains Tax (CGT) you pay. Or paying yourself dividends could reduce your Income Tax liability.

Understanding tax rules and which ones make sense for you can be difficult. So, seeking professional support can mean you’re better off financially overall.

8. Set up regular financial reviews

Finally, over time your goals and financial circumstances will change. Regular financial reviews can help ensure the steps you’re taking are still appropriate and support your wider goals.

To create a financial plan that will include frequent reviews to make sure you remain on track, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The value of your investments (and any income from them) can go down as well as up, which would have an impact on the level of pension benefits available.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances. Levels, bases of and reliefs from taxation may change in subsequent Finance Acts.

The Financial Conduct Authority does not regulate tax planning.

read more“Midlifers” are hit by time and financial pressures. Financial planning can help balance your priorities

by helen hall on April 1, 2022Individuals aged between 40 and 60 – dubbed “midlifers” – are facing time and financial pressures as they try to support their families. Many are feeling the strain and don’t have the resources to focus on their own goals, and financial planning could help.

According to a survey from Legal & General, 6 million midlifers are finding themselves caught in the middle of providing financial support to adult children and providing unpaid care to ageing relatives. On top of this, it’s a crucial period for securing their own financial future and retirement.

The research found 17% of midlifers provide financial support to another adult, totalling £10 billion a year.

- Those supporting grown-up children provide, on average, £247 a month.

- Midlifers financially helping elderly parents or other relatives spend, on average, £282 a month.

The findings suggest that at age 45, you’re likely to have the greatest level of financial responsibility, while age 58 is when you’re most likely to start taking on some care responsibilities.

It’s natural to want to lend support to your loved ones, but it can harm your own lifestyle and long-term goals. While retirement can seem a long way off when you turn 40, it’s an important milestone to start thinking about. The steps you take now could affect the lifestyle you enjoy in your later years.

10% of midlifers feel the level of support they provide is unsustainable

The research worryingly found that 10% of midlifers feel that the support they provide is already unsustainable. If you’re supporting loved ones, a financial plan can help make it part of your budget and balance the support with other priorities.

If you’re neglecting your pension or other steps that could improve your long-term financial wellbeing, financial planning can help highlight potential challenges in the future and show you how to reduce risks. It means you’re in a better position to meet the demands you’re facing now and still secure your future.

It can also help you make decisions about the financial support you’re offering.

For instance, if you’re helping adult children with rental costs, would providing a lump sum to act as a house deposit make more sense? It could reduce their outgoings overall and provide long-term stability. It’s an option you may have dismissed or not even considered, but we can help you review your finances to see if it’s right for you.

If you’re struggling to provide care for a loved one, paying for some professional support can also make sense. This doesn’t have to mean a care home but could be someone that checks in with them every day. It can relieve some of the pressure you may be feeling while still ensuring your loved one is getting the additional support they need.

A financial plan can help you confidently support the people who are important to you.

19% of midlifers spend no time on their own financial wellbeing

As well as having a direct effect on expenses and how your money is used, supporting others can reduce the amount of time you have to organise your own life.

25% of people aged between 40 and 60 said they get less than an hour to themselves in the average day. Almost a fifth (19%) said they have no time to spend on their own financial wellbeing.

Financial planning doesn’t just provide you with a plan to reach your long-term goals. It can help you make the most of your time and reduce how much admin you need to do to stay on track.

As your financial planner, we can provide you with confidence in your financial future and set regular reviews, so you don’t have to worry about how your pension is performing or whether you have adequate financial protection day-to-day. This step means you can focus on what’s important now while knowing that your long-term financial wellbeing is secure.

Financial planning can help you get the most out of your money and time. Please contact us to arrange a meeting.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

read moreWhy it pays to use your 2022/23 ISA allowance right now

by helen hall on April 1, 2022The 2022/23 tax year has only just started, but you should already start thinking about how you’ll use your allowances over the next 12 months. It can help maximise your assets.

In the 2022/23 tax year you can deposit up to £20,000 into ISAs. If you don’t use this allowance before the end of the tax year, you lose it. You can save or invest tax-efficiently through an ISA, so making full use of your allowance can help your money go further.

The period from February to the beginning of April is sometimes dubbed “ISA season” as savers and investors scramble to find the best rates to make use of their allowance before the end of a tax year.

If you left using your 2021/22 ISA allowance until the deadline was near, don’t let your ISA slip your mind now. It’s worth thinking about maximising it earlier in the 2022/23 tax year. Here’s why.

Drip-feeding your deposits can make your ISA goal part of your budget

If you want to maximise your ISA allowance or have a goal for how much you want to put in, making regular deposits a part of your budget can help.

Depositing £1,666 into your ISA each month can be more manageable than adding a lump sum at the end of the tax year. If you don’t have a lump sum to add to your ISA, breaking down your end goal can make sense.

It can help ensure that the money doesn’t get used to cover other expenses and keep you on track.

If you’re thinking about breaking down your ISA deposits over the year, setting up a standing order can simplify it.

In addition to making deposits more manageable, drip-feeding your money can be useful if you’ll be investing through an ISA.

Investment markets will rise and fall throughout the year. So, by spreading out deposits, you’ll be buying at different points throughout the market cycle. It’s an approach that can remove the temptation to try and time the markets.

Depositing a lump sum now means you have longer to earn interest or returns

If you already have a lump sum available to deposit, doing so now means you could have an extra 12 months of interest or returns than you would if you waited until April 2023.

If you’ll be saving through a Cash ISA, the extra interest added to your account over the year can really add up. Using your ISA allowance now can help you make the most of your money.

Adding a lump sum if you’ll be using a Stocks and Shares ISA to invest means you can potentially benefit from an additional 12 months of investment returns.

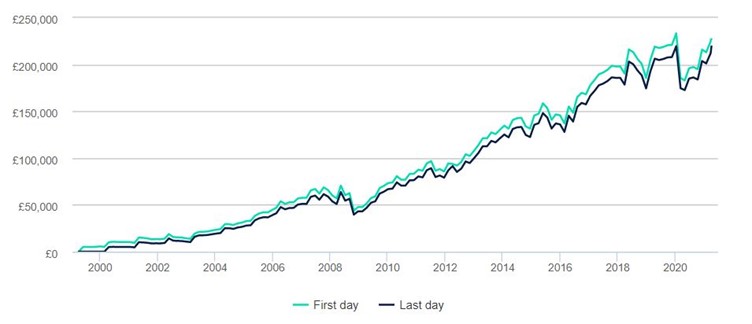

The graph below shows how investing £5,000 each tax year delivers different returns if you invested on the first working day of the tax year compared to the last working day.

Source: Hargreaves Lansdown

While both options have done well and returned over 99% growth, you would be better off by investing at the start of the tax year overall.

However, you should keep in mind that investment performance cannot be guaranteed.

Some years, investing at the start of the tax year could mean you end up with less if investments perform poorly. You should consider your investment time frame and risk profile when making investment decisions and reviewing performance.

Should you save or invest through your ISA?

If you want to use your ISA allowance for the 2022/23 tax year now, you should think about whether a Cash ISA or a Stocks and Shares ISA is right for you.

A Cash ISA is a useful way to save. Your savings will benefit from interest, however, as the interest rate is likely to be lower than inflation, your savings may be losing value in real terms.

Over the long term, the effects of inflation add up. As a result, a Cash ISA may be right for you if you’re building an emergency fund or are saving for short-term goals.

If you’re putting money away with long-term goals in mind, a Stocks and Shares ISA may be appropriate.

Investing provides a chance for your wealth to grow at a pace that matches or exceeds inflation. But this cannot be guaranteed, and market volatility can mean investment values fall.

Investing for a longer period can smooth out the ups and downs. As a result, you should invest with a minimum time frame of five years.

As well as time frame, you should also assess which investments are right for you. All investments carry some risk and the decisions you make should reflect your wider financial circumstances.

Are you ready to think about how to maximise your ISA allowance for the 2022/23 tax year?

Please contact us to discuss your options and the steps you can take to help your money go further, including using your ISA and other allowances this tax year.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

read moreYour older pensions could be delivering “poor value for money”, and it could cost you thousands of pounds

by helen hall on April 1, 2022If you opened a defined contribution (DC) pension in the 1990s or 2000s, the charges you’re paying could be higher than comparable pensions opened more recently. Between now and your retirement, the difference could add up to thousands of pounds.

Research conducted by the Institute for Fiscal Studies found that many older DC pensions deliver “poor value for money”. Among people in their 50s, the average annual fee for a DC pension taken out in the 1990s is above 1.1%. This compares to a charge of 0.8% for DC pensions opened in the last decade.

The difference between 1.1% and 0.8% can seem small. However, over the decades your pension will be invested, it can add up.

For example, a 50-year-old with a pension worth £21,000 could have an additional £2,400 at the age of 67 if they switched from a pension charging 1.1% to one with a 0.8% fee. This example assumes that annual investment returns in the future are the same as the average over the last five years.

The larger your pension, the more you could gain by switching.

The research assessed the returns of different pensions too. It found that the higher fees of older pensions are not justified by better performance in many cases. So, if you do have an older DC pension, moving your retirement savings to another scheme could make sense.

Kate Ogden, a research economist at the Institute for Fiscal Studies, said: “It is vital that people get the most out of the retirement saving they have done over their working lives. This won’t happen automatically. Older pensions risk becoming poor value for money. The fee charges are often higher than those on pensions taken out more recently.”

In addition to potentially higher charges, older DC pensions may not be invested in the way you’d like. Asset allocation decisions you made many years ago may no longer suit your retirement plans.

Your pension should reflect your investment risk profile and other factors, like when you plan to retire.

Even if you’re no longer contributing to a pension, it’s important to continue to assess performance and engage with it to ensure it helps you reach your goals.

What value is your pension delivering?

If you took out a DC pension a long time ago, it’s likely delivering poor value for money in terms of charges. The research found four-fifths of pensions started in 2013 have a charge of 0.75% or less. In contrast, just 1 in 9 pensions opened in 1993 do.

To determine the value of your pension, you should assess what fees you’re paying and compare this to alternatives available today. It could save you thousands of pounds, which can then be invested to boost your retirement savings.

Charges are an important part of reviewing your pensions, but you shouldn’t automatically switch your pension if they are high. There may be other things that make the pension valuable, such as:

- Investment performance: You should review charges in the context of the pension’s performance. A higher charge may be justified if your retirement savings are growing at a faster pace.

- Greater flexibility: Some older pensions may allow you to access your savings sooner than newer pensions. If you want to retire early, this can provide you with more freedom.

- Guaranteed annuity rate (GAR): Some older pensions may have a GAR. Today’s annuity rates are typically lower than the 1990s and earlier, so you could receive a higher retirement income by retaining an older pension.

Before you make any decisions about your pension, you should carefully review it. Once you’ve left a scheme, you may not be able to go back, and you could lose any benefits you hold now. You may also need to pay an exit fee.

Transferring your pension

If you decide that a pension isn’t delivering value, you’ll need to find another pension scheme to move your savings to. This could be an existing pension or one with a different provider.

There are a lot of pension providers to choose from. You should consider the fees of pension schemes as well as other factors, such as the choice of investment funds on offer and past performance, although you should remember that past performance is not a guarantee of future performance.

Some providers may also have minimum or maximum contribution levels or require regular deposits.

With so many providers to choose from, it can be difficult to know which option is right for you. If you have questions about your current pension or are thinking about switching, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation, which are subject to change in the future.

read moreDisclaimer: The information provided in our website blogs is accurate and up-to-date at the time of writing. However, please be aware that legislative changes and updates may occur after the publication date, which could potentially impact the accuracy of the information provided. We encourage readers to verify the current status of laws, regulations, and guidelines relevant to their specific circumstances. We do not assume any responsibility for inaccuracies or omissions that may arise due to changes in legislation or other factors beyond our control.

If you would like any clarification, or have any questions, please get in touch.